The CBOE index of implied correlation made the news recently, with a high of 72. This index, JCJ, is not as well-known as the one for implied volatility, but the two are linked. Low correlation suppresses volatility, due to the diversification effect. Math geeks may refer to the algebra in my earlier post on this topic.

High correlation is newsworthy when it suggests an indiscriminate selloff. In a panic, as they say, all correlations go to unity. Intuitively, you would expect a healthy bull market to show a middling amount of correlation as leadership rotates among generally rising issues. I wrote a Python script to help me look at this.

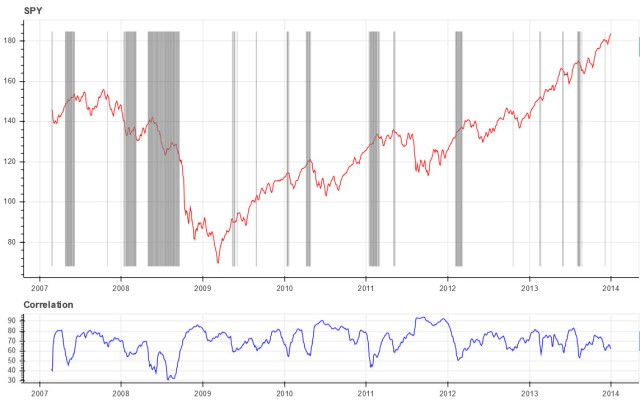

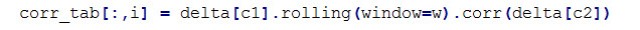

My correlation indicator is the average of the pairwise correlations among the nine “sector spider” funds, over a 20-day window. Twenty days is what I would normally use with the Stockcharts CORR() function, to compare SPY with, say, Treasury yields or commodities. The script allows me to experiment with different parameters.

My correlation indicator is the average of the pairwise correlations among the nine “sector spider” funds, over a 20-day window. Twenty days is what I would normally use with the Stockcharts CORR() function, to compare SPY with, say, Treasury yields or commodities. The script allows me to experiment with different parameters.

In the chart, I have also smoothed both SPY and the indicator with a five-day moving average. This is just to make the long series easier to interpret. The gray bars highlight periods when the correlation indicator is below 60.

In contrast to high correlation, low correlation suggests a period when the market is “looking for leadership.” It appears reliably around local tops. You see plenty of this in 2008, obviously, but also note the two very precise warnings in 2010. The indicator tends to swing from these low values up to 80 or more, as price rolls over the tops. Note also, the steady bull market that begins in 2012, with correlation contained between 50 and 80.

Finally, note that the CBOE calculates their measures of implied volatility and correlation based on option prices. Mine is a trailing indicator, based on historical correlation. It is to JCJ as STDEV() is to the VIX.