Part one in a series

When you read about portfolio management, the emphasis is typically on selecting issues for diversification – an inflation hedge, real estate, bonds, etc. The allocation of capital within the portfolio is then revised periodically (rebalanced) based on some rules. Nowadays, you can do this entirely with ETFs.

In this post, I will present some alternative balancing models, with different risk return characteristics. Requirements for each model are:

- Mechanical rules suitable for a nonprofessional (or a robot)

- Balance once each month, to reduce commissions

- Rule for going to cash

The choice of ETFs is secondary. The main thing is that they be diverse. That is, weakly (or negatively) correlated with each other. I’ll come back to that in a later post. For now, I present this portfolio without comment:

- SPY – SPDR S&P 500 ETF Trust

- EFA – iShares MSCI EAFE Index Fund

- IEF – iShares Barclays 7-10 Year Treasury Bond Fund

- TIP – iShares Barclays TIPS Bond Fund

- EEM – iShares MSCI Emerging Markets Index

- IWM – iShares Russell 2000 Index

- XLB – Materials Select Sector SPDR

- IYR – iShares Dow Jones US Real Estate

- TLT – iShares Barclays 20+ Yr Treasury Bond

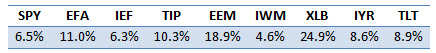

The chart below shows their performance over the ten year period. It’s hard to look at, but you can see the 2008 crisis and the jump in bond prices.

This is end of month data, and the period is January 2004 through January 2014. We are going to write our rebalancing rules based on the month end figures, and assume we can buy at roughly that price to start the new month. We are also going to assume a smooth allocation to the ETFs, disregarding lot sizes.

This is end of month data, and the period is January 2004 through January 2014. We are going to write our rebalancing rules based on the month end figures, and assume we can buy at roughly that price to start the new month. We are also going to assume a smooth allocation to the ETFs, disregarding lot sizes.

The chart below shows the performance of a balanced portfolio versus SPY. We start with $1,000 in each of the nine ETFs, plus $1,000 cash. Each month, we rebalance the total, one tenth into each category. I call this the “equal allocation” model. It is probably the most natural, intuitive way to do it.

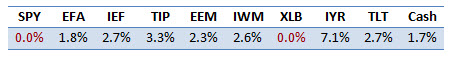

This model performs slightly better than SPY, returning 68% over the period versus 58%, and with less risk. The standard deviation of monthly returns to the model is 3.2% versus 4.2% for SPY alone. It does not perform as well as some of the other issues, in absolute or risk adjusted terms. Since TIP is handy in the portfolio, we’ll use it to compute Sharpe ratios for whole group:

This model performs slightly better than SPY, returning 68% over the period versus 58%, and with less risk. The standard deviation of monthly returns to the model is 3.2% versus 4.2% for SPY alone. It does not perform as well as some of the other issues, in absolute or risk adjusted terms. Since TIP is handy in the portfolio, we’ll use it to compute Sharpe ratios for whole group:

The ETFs to beat are EEM and IWM, for absolute and risk adjusted returns, respectively.

The ETFs to beat are EEM and IWM, for absolute and risk adjusted returns, respectively.

Perhaps you have noticed a flaw in the logic of this model. As Loeb says in his book, it has the effect of moving capital from issues that are performing well, and “spreading the wealth” to those that are not. For the next model, we rebalance pro-rata according to how well each fund has done over the last month. Here’s how that performs:

In the first month we start with equal allocations, and we make a 2.3% return (actually, a little less because we start with $1,000 allocated to cash).

In the first month we start with equal allocations, and we make a 2.3% return (actually, a little less because we start with $1,000 allocated to cash).

For the next month, we allocate according to how each fund performed as a percentage of the total. This “total” figure only serves to make the pro-rata calculation. Here is the result:

For the next month, we allocate according to how each fund performed as a percentage of the total. This “total” figure only serves to make the pro-rata calculation. Here is the result:

In this month, XLB did best, so it gets the most capital going into the next month. This approach kind of assumes that last month is a predictor of next month’s performance, but not really. That’s a proven fallacy. What the model assumes, after Levy, is that last month’s relative rankings within the group are predictive.

In this month, XLB did best, so it gets the most capital going into the next month. This approach kind of assumes that last month is a predictor of next month’s performance, but not really. That’s a proven fallacy. What the model assumes, after Levy, is that last month’s relative rankings within the group are predictive.

I call this the “winners only” model, because it allocates only to those issues making gains. Its average monthly return of 1.1% dominates EEM, and its variability is less than SPY.

Results for this model are impressive, but it has some drawbacks. In some months all issues lose money, leaving no choice but to reuse the prior month’s rankings. It also cannot go to cash. Finally, the model produces a very erratic mix of issues from month to month. The chart below shows the portfolio mix for a representative year:

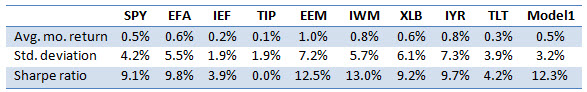

This is the killer. No one would think of running a retirement portfolio like this. For the next model, we keep the pro-rata concept, but we resolve to stay in nine of the ten issues (counting cash) every month. We do this by baselining all issues relative to the month’s worst performer. For example, in a month where the returns are:

This is the killer. No one would think of running a retirement portfolio like this. For the next model, we keep the pro-rata concept, but we resolve to stay in nine of the ten issues (counting cash) every month. We do this by baselining all issues relative to the month’s worst performer. For example, in a month where the returns are:

We find the biggest loser, 2.6%, and add that amount to each return:

We find the biggest loser, 2.6%, and add that amount to each return:

Then, we repeat the pro-rata allocation as before. Note that cash, which always returns zero, receives an allocation when any other issue makes a loss. I call this the “drop one loser” model. In this example, XLB is the biggest loser, and so the portfolio will hold no shares of XLB in the next month. If all issues make gains, then cash is weakest, and the model goes fully into ETFs.

Then, we repeat the pro-rata allocation as before. Note that cash, which always returns zero, receives an allocation when any other issue makes a loss. I call this the “drop one loser” model. In this example, XLB is the biggest loser, and so the portfolio will hold no shares of XLB in the next month. If all issues make gains, then cash is weakest, and the model goes fully into ETFs.

This one is not as chaotic as model #2, but it also doesn’t perform as well. Its monthly average return of 0.7% is weaker than IWM. I’ll give a thorough comparison at the end.

This one is not as chaotic as model #2, but it also doesn’t perform as well. Its monthly average return of 0.7% is weaker than IWM. I’ll give a thorough comparison at the end.

Finally, I find a middle ground between models #2 and 3, by baselining to the second weakest performer. Thus, the month shown above would be baselined to -1.7%, dropping SPY as well as XLB.

I call this the “drop two weakest” model. I could go on with dropping three, etc. This one has, to my eye, the right amount of churn from month to month. Here is 2005 again. If you compare it with the histogram above, you can see the resemblance (the colors are the same). Model #4 tends toward the same issues as #2, but it doesn’t go all in.

I call this the “drop two weakest” model. I could go on with dropping three, etc. This one has, to my eye, the right amount of churn from month to month. Here is 2005 again. If you compare it with the histogram above, you can see the resemblance (the colors are the same). Model #4 tends toward the same issues as #2, but it doesn’t go all in.

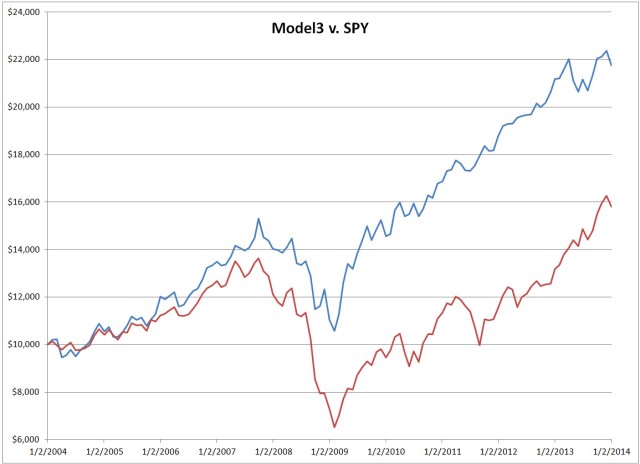

The chart below shows all four models on the same chart. Model #2 is the overall best performer. Its superior return and low drawdown compensate for its higher variability. If this were my IRA, though, I would go with the less erratic model #4.

The chart below shows all four models on the same chart. Model #2 is the overall best performer. Its superior return and low drawdown compensate for its higher variability. If this were my IRA, though, I would go with the less erratic model #4.

Safe, timid, model #1 has the worst drawdown of the bunch. It continued shoveling money into stocks during 2008. That’s why “equal balance” models need explicit warning signals to move out of stocks. The other three models have implicit warning signals that move them seamlessly into cash and bonds. Here is the drawdown chart:

Safe, timid, model #1 has the worst drawdown of the bunch. It continued shoveling money into stocks during 2008. That’s why “equal balance” models need explicit warning signals to move out of stocks. The other three models have implicit warning signals that move them seamlessly into cash and bonds. Here is the drawdown chart:

The table below summarizes results for the four models. I like to see the returns and variability on a monthly basis, instead of discounting the total return. I think that’s more appropriate for this application. Apart from that, my Sharpe ratio is conventional, using TIP as the risk free return.

The table below summarizes results for the four models. I like to see the returns and variability on a monthly basis, instead of discounting the total return. I think that’s more appropriate for this application. Apart from that, my Sharpe ratio is conventional, using TIP as the risk free return.

As long as you have negatively correlated issues to work with, you can achieve your desired risk return tradeoff by tweaking the model. It’s kind of like the CAPM of portfolio balancing. I will cover the selection of ETFs in a later post.

As long as you have negatively correlated issues to work with, you can achieve your desired risk return tradeoff by tweaking the model. It’s kind of like the CAPM of portfolio balancing. I will cover the selection of ETFs in a later post.